Richard Fyfe explains why sticking with the plan remains the best course of action and illustrates how we plan ahead and stress test our financial plans to ensure they can withstand extreme market conditions.

Ukraine, Energy & Inflation

It’s now been a few weeks since we emailed about Russia’s invasion of Ukraine and its potential effect on investment markets. This conflict is still ongoing and energy shortages and rising inflation have only added to people’s worries. Here we explain why, despite these issues, we remain positive looking forward if we stick with our existing investment strategy and financial plan.

Nothing New

During my 20 years in financial services, there have always been geo-political issues that will potentially affect investment markets and this year’s events are no different. Over the long-term we can remain positive that markets will head in the right direction as they have in the past.

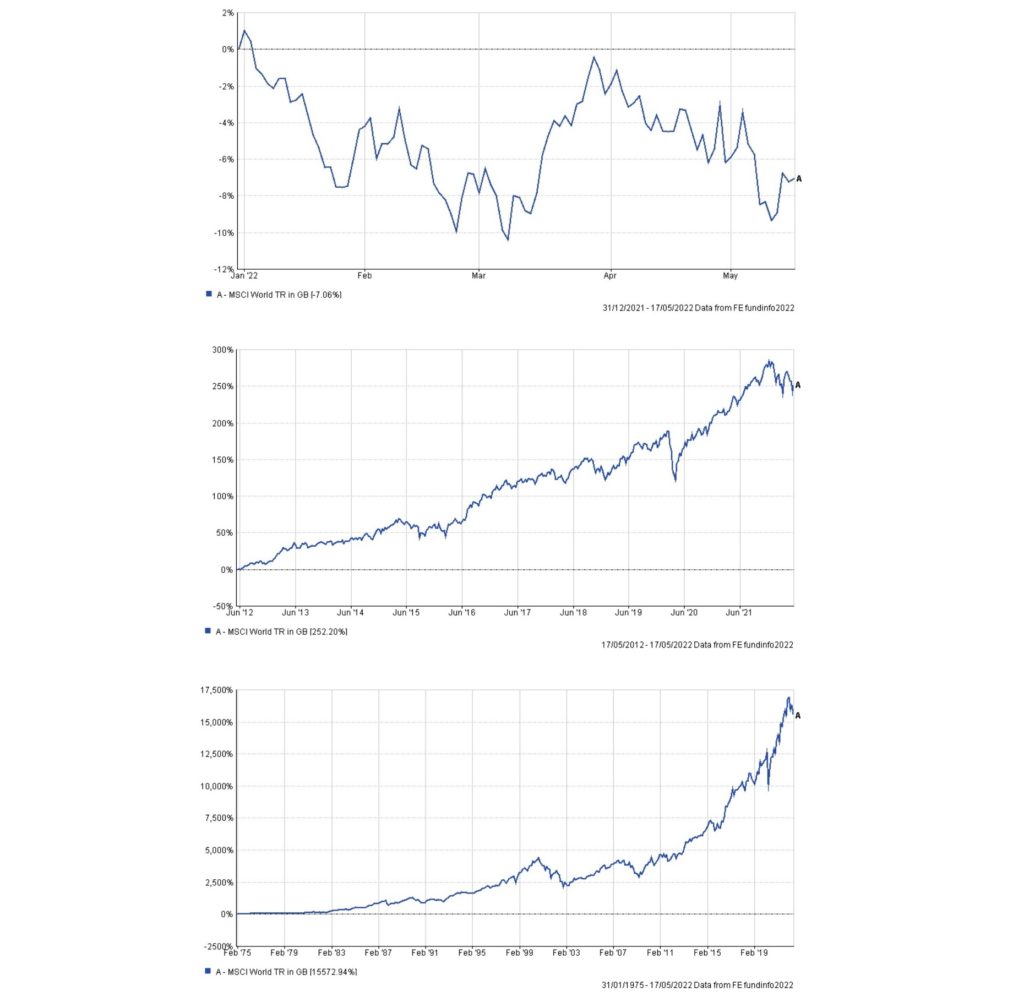

Investment markets had already begun to fall at the start of the year, even before the invasion of Ukraine, and have continued to gradually tick downwards since.

The global market, represented by the MSCI World Index, is down almost 10% since 1st January.

We still don’t know where markets are headed in the short-term but if we look back over the last 5 years, we can see that returns are in positive territory over any period longer than 12 months.

The further you go back, the better things look and historically, over the past 45 years, markets have generally only gone in one direction.

Our View

We believe that if the world of tomorrow looks anything like the world of today, and we’re still buying goods and services from each other, shopping online and in supermarkets and eating in restaurants, investment markets will continue to rise over the long- term. We just need to make sure we’re invested in those companies that we support every day with our purchases and that means owning a share of all the best companies across the globe.

We don’t need to place bets on individual stocks, individual countries, or individual sectors, we just need to own the broad market and let it do its job. We don’t need to pick the next Amazon or the next apple. We just need to make sure we don’t only pick the next Kodak or Blockbuster Video. Our investment portfolios hold over 10,000 different companies across the globe. Some companies might fail but the others will flourish. When the broad market will deliver over long-term, there is no need to risk missing out on those returns by aiming to needlessly shoot the lights out.

Timing Markets

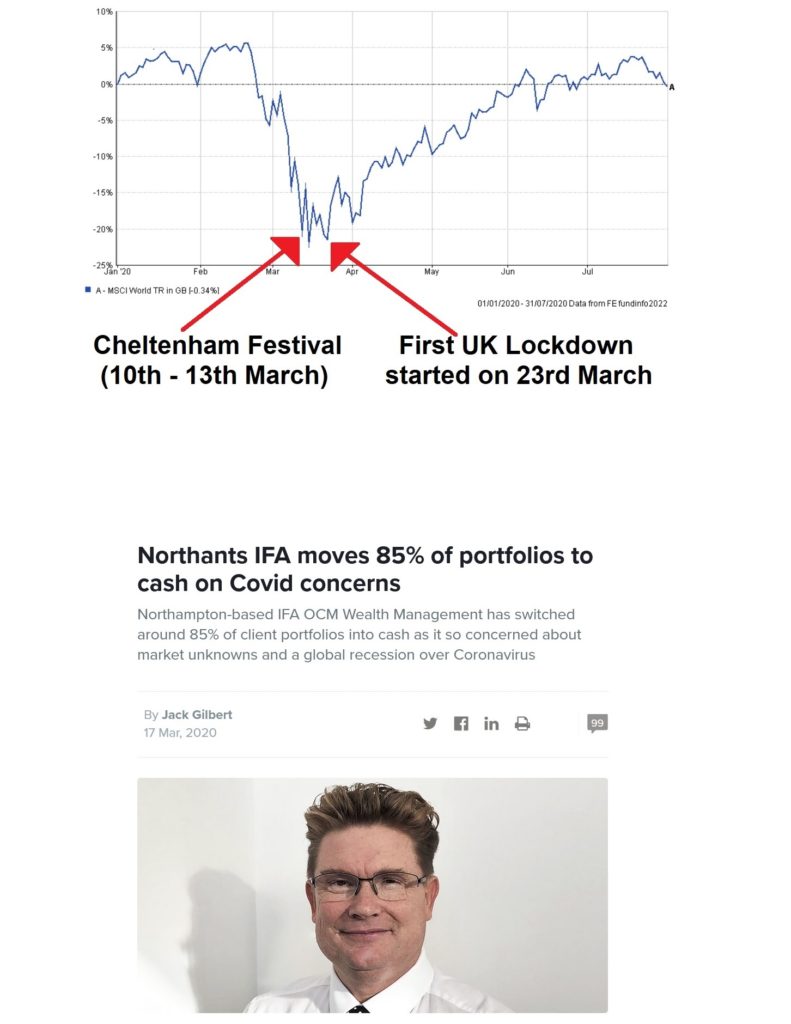

Whilst we’re optimistic about financial markets in the long-term, it is harder to predict what’s going to happen in the short term. We know that we will see blips and crashes from time to time. If we know we’re in the midst of a crash, would it not make sense to move out of the market to limit our losses? Unfortunately, that’s easier said than done. Over the past decades there have been numerous blips that didn’t turn in to full market crashes. Getting out of the market is only one decision to time correctly. The other is when to get back in. And if the crash doesn’t materialize, as they often don’t, it becomes very difficult to know when to reinvest.

It’s impossible to predict how markets are going to move and this was clearly illustrated back in Spring 2020 when Covid hit. It took markets only 17 trading days to fall from their peak to the bottom of the crash. Racing fans were still attending Cheltenham Festival as markets reached the bottom and were already recovering when the UK entered its first lockdown. The chances of successfully timing movements both in and out of markets are extremely low. The best option was simply to sit tight and ride it out.

However, there was a story in the financial press about an IFA in Northamptonshire who moved 85% of his clients’ money out of the market during the Covid pandemic. This article was published on 17th March 2020, one day after the market had already reached its lowest point. These losses had been regained within 3 months and it would appear likely that this adviser’s clients will not have fared well because of this strategy.

The better option was again shown to be sitting tight, sticking with the plan and riding out the ups and downs we know we will see over the long-term.

Cash

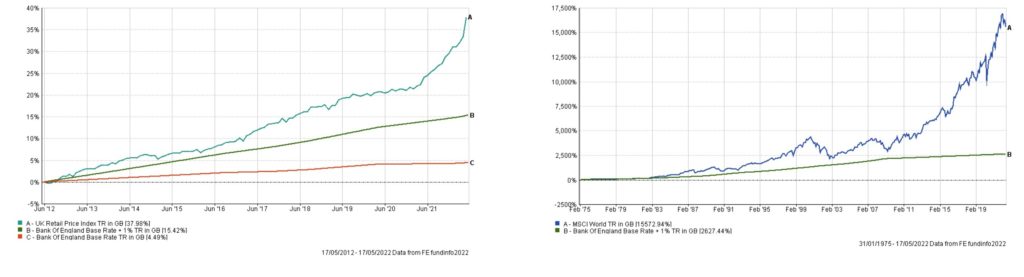

Whilst we have hopefully illustrated that attempting to time markets is a fool’s errand, what about selling out permanently and staying in cash? Once again, we don’t see this as a viable strategy for most investors. Cash returns have significantly trailed inflation over the last 10 years meaning a real terms loss of capital.

Of course, interest rates have been particularly low over the last decade and have now started to rise. However, the position over the long-term is just as stark with investment markets significantly outstripping cash over the last 5 decades. Cash does not appear to be a viable solution to growing your wealth over the long-term.

Your Financial Plan

We hope that the argument for staying invested stands up in its own right. However, we also want to make clear that we can have confidence in this strategy individually because we know these bumps in the road will come along from time to time and we have planned ahead for them and stress tested your financial plans to ensure they can withstand extreme market conditions.

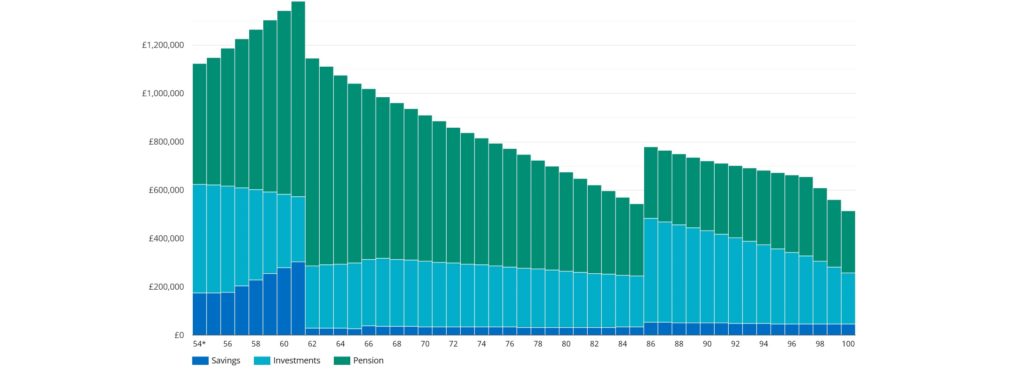

The ‘dummy’ financial plan below will hopefully look like your own. You will recognise how our fictional client’s life plan has been planned out on the Events Timeline.

The most notable item is the planned purchase of a holiday home shortly before retirement. Needing to withdraw a large sum of money from an investment presents a significant risk because an investor could be disadvantaged if markets have fallen at the time the money is needed. Knowing this was on the agenda would allow us to identify how much it would likely cost, confirm how much cash was in place already and ultimately plan how to fund the purchase from her investments. In this instance, we were able to slowly draw the required funds from her investments over the 5 years preceding the purchase to minimise the impact of any potential market falls.

Our fictional client will also need an income in retirement and the use of a lifetime cash flow forecast allows us to plan how to fund this retirement without her running out of money. The forecast below nicely illustrates the sustainability of her financial plan.

It’s also nice to see that she is left with a sizable margin for error left at the end of the plan!

Stress Testing

In the financial plan above, we can be confident that we’ve planned ahead, funded our client’s retirement and left her with a healthy sum in the bank at the end, in case life throws up any surprises. However, we haven’t yet stress tested it to ensure it can withstand whatever markets throw at it.

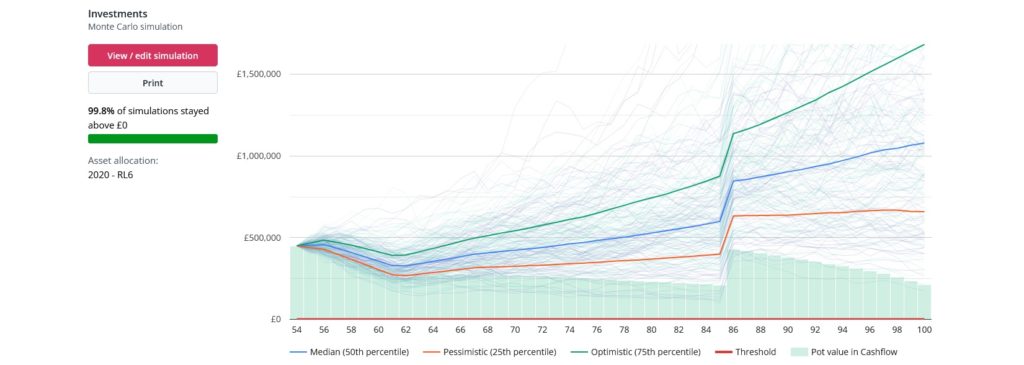

Our biggest worry would be the coincidence of a long, deep market crash at the same time as starting retirement and it’s important to stress test whether the plan could cope. The peculiar looking chart below is our financial planning software running 10,000 different simulations to estimate the likelihood of our client’s assets sustaining her desired lifestyle throughout the rest of her life. These include scenarios of varying investment returns and inflation rates.

In this case, the stress test estimated that our client’s pensions and investments would sustain the required income and withdrawals in 99.8% of scenarios. Therefore, in only 0.2% of scenarios would she need to make significant changes to her lifestyle in the future. We are therefore happy that this represents a very solid stress test and that our fictional client’s financial plan is capable of withstanding the ups and downs that her investments will experience during her multi-decade retirement.

Conclusion

I hope that we have been able to illustrate that sitting tight and sticking with the plan is the best investment strategy in general terms. I also hope that it’s clear that we’ve mapped out your financial plan, looked at what the money is going to be spent on and when, and we’ve stress tested it to make sure it can withstand extreme market conditions. So please be reassured that your investments are in safe hands and your financial plan remains on track.

If you do have any further worries, we would be more than happy to discuss them with you. Please get on touch with us on 0114 262 1943 or info@fyfefinancial.co.uk to arrange a call.

Richard Fyfe

Director & Chartered Financial Planner at Fyfe Financial

Please note that the article above, including the embedded video presentation, does not constitute financial advice nor a personal recommendation. The value of your investment is not guaranteed, and unit prices can fall as well as rise. Information on past performance, where given, cannot be relied upon as a guide to future performance. For any investment you make, you may get back less than you invested.