Richard Fyfe explains why we shouldn’t panic despite the chaos surrounding the UK economy.

This is a quick update following Kwasi Kwarteng’s recent mini budget.

The position is of course worrying, particularly for anyone with a mortgage, but I’m here today to hopefully provide some reassurance and explain why we shouldn’t panic.

Kwarteng’s Mini-Budget

As you may have seen, markets reacted badly to the recent financial statement. Sterling has fallen, interest rates have risen, and mortgages are going to become more expensive.

No one knows exactly what is going to happen from here.

Everyone seems to be panicking and overreacting, potentially even including our Prime Minister and Chancellor, financial markets, The Bank of England and mortgage lenders.

Rising Interest Rates

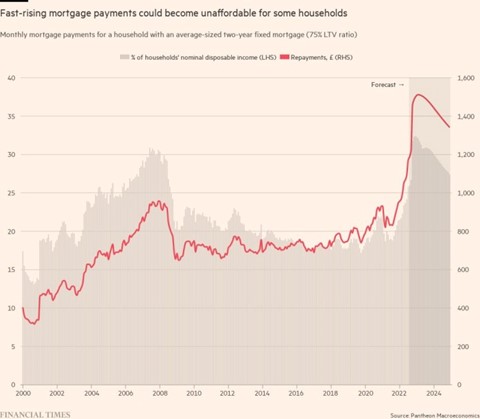

Financial markets are already pricing in 6% interest rates and lenders are pricing this into their mortgage deals too. I don’t know what’s going to happen in the future either, but I do want to have a look at both sides of what’s going on.

As I’ve said, mortgage lenders are already pricing in much higher rates into their deals. They’re panicking and protecting themselves against rates going up and up.

Of course, mortgage rates could go up even further still. But the position would have to get worse for this to happen.

Sterling to fall even further than it has already. Inflation to stay high longer than expected. And for base rate to then rise more than has already been priced in.

Of course, this could happen, but rates are already pricing in a particularly pessimistic view.

Hopefully, what we’re seeing now will subside when inflation comes down. The fall in sterling isn’t helping but there are reasons why inflation ought to fall over the short term.

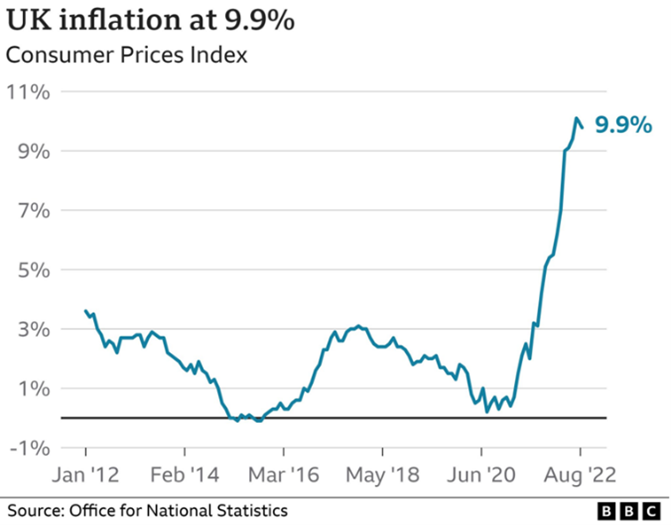

Inflation

As we know, inflation hit around 10% a couple of months back, but it does look like we may have seen the peak and rates of inflation starting to head in the right direction again.

Petrol Prices

Drivers will already have noticed falls in petrol prices at the pumps and we’ve generally seen reductions of between 15% and 20% over the last few months.

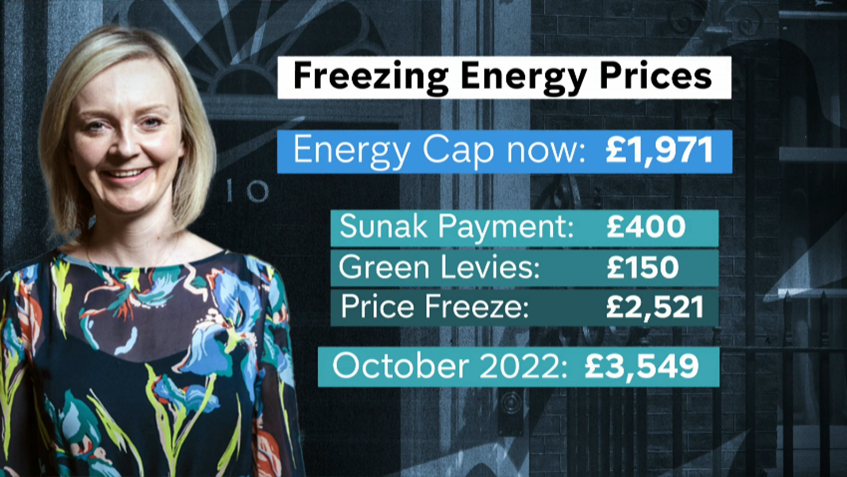

Energy Cap

Since Liz Truss was appointed Prime Minister, the Government have announced an energy cap. This will limit the average annual bill for a family of four to £2,500 which is £1,000 less than would have been the case without the cap.

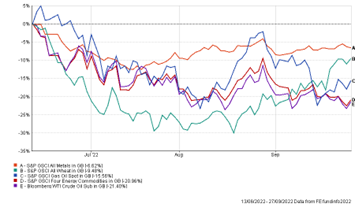

Energy & Commodity Prices

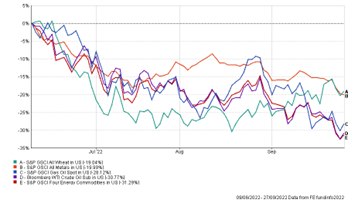

Of course, the cap doesn’t affect the price of the underlying energy. However, we have seen significant falls in the price of energy as well as other commodities over the last few months.

Gas, oil, metals, wheat have seen falls of around 20% to 30% over this period.

Exchange Rates

We’re yet to fully benefit from this in the UK as most of these commodities are priced in US dollars and due to the fall in Sterling, these price reductions haven’t come through to the same degree.

However, we’ve still seen falls in the prices of these commodities at between 5% and 20%, even here in the UK priced in sterling.

Even though the Bank of England will continue to raise interest rates over the coming months, inflation will hopefully start to fall and interest rates will then be able to fall back to a more reasonable level.

This certainly won’t be 1% a year anymore, but hopefully it won’t be 6% a year either.

Your Financial Plan

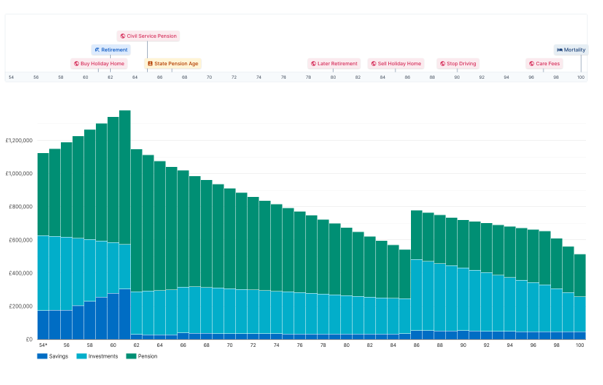

We would always encourage our clients to link everything that is going on back to their own financial plan.

A lot of work and research goes into these plans and forecasts to make sure that our assumptions for inflation, interest rates and investment growth are reasoned, reasonable and also relatively cautious.

We also stress test our plans and forecasts to ensure they can withstand extreme economic conditions like those we’re experiencing at the moment.

So, although it’s a worrying time, if your financial plan was robust and sustainable six months ago, it should still be today.

That’s not to say there will never be any adjustments to be made. But you should hopefully be able to sleep at night knowing your finances are going to be okay.

Mortgages

For those with mortgages, I wouldn’t necessarily recommend rushing into securing a new deal, particularly if you have to pay an exit penalty to do so.

Hopefully, the mortgage deals available in a year or two’s time might be better than those available today. And this should be the case if inflation does fall.

However, a significant reason for taking action now is affordability. If mortgage rates rise further, is there a point after which your family’s financial security would be put at risk?

If so, it might be worth securing your deal now, to know that you can afford it irrespective of expectations going forwards.

I think a lot of people are probably going to end up paying much higher interest rates for a couple of years but will probably choose to balance this out by extending their mortgage term to keep repayments at a similar level to what they pay now.

Overall, for those with mortgages, I would say don’t panic but do look at your own position to understand your options and what you can afford. What are you paying now? What would the exit penalties be? Would you be able to extend your mortgage term? How much would your repayments be at the rates available today and what would they be if rates rose further?

For those worried about their mortgages, I would recommend that you speak to your mortgage broker, but please understand that this is a very difficult time for them too.

For anyone worried about their broader financial plan, please get in touch on 0114 262 1943 to discuss this further with us.

Please note that the article above, including the embedded video presentation, does not constitute financial advice nor a personal recommendation. The value of your investment is not guaranteed, and unit prices can fall as well as rise. Information on past performance, where given, cannot be relied upon as a guide to future performance. For any investment you make, you may get back less than you invested.