The headline figure for wage growth of 4.5% in late 2020 – the highest level in almost two decades – is too good to be true, according to the Resolution Foundation. The thinktank argues the furlough scheme and job losses for lower-paid workers have skewed the data.

The organisation’s Earnings Outlook states that earnings growth was far weaker than data suggests. In fact, the median pay rise among individual workers was just 0.6% in the third quarter of 2020, a real-terms pay cut of 0.2%. While the final quarter of 2020 shows a median pay rise of 1% in real terms, it was still the second-lowest since mid-2013.

Across the entire workforce, it’s estimated that around half of workers suffered a pay cut in 2020 once inflation is considered.

Young workers are most likely to experience wage growth, as they are establishing their career and are more likely to swap jobs. The data highlights the impact Covid-19 has had on younger generations. Among 18- to 24-year-olds, annual pay growth fell from 12.3% in 2019 to 6% in 2020. Among 25- to 35-year-olds wage growth fell from 4.9% to 1.4% over the same period.

While still experiencing a rise, the Resolution Foundation notes that sharp falls during a crucial early stage of careers can potentially “scar” pay prospects for years to come.

Hannah Slaughter, an economist at the Resolution Foundation, said: “The economy experienced its biggest recession in over 300 years, with a third of private sector workers put on furlough at its peak. And yet somewhat implausibly, pay growth reached its highest level in almost 20 years.

“Sadly, the story of bumper pay packets from official headline data is too good to be true. In reality, half of all workers experienced a real-terms pay cut last autumn.”

What does a real-terms pay cut mean?

You may not notice a real-terms pay cut. The amount you take home will be the same or it could even be more. However, your income won’t go as far. This is because inflation, or the cost of living, has increased more than your income.

Small increases in inflation often go unnoticed but over time they can add up and have a real impact on your spending power. The 12-month inflation rate in December 2020 was 0.8%. This is relatively low, but when you compare it to wage growth, many workers will find their spending power has diminished.

A real-terms pay cut of 0.2% might not make much difference to your lifestyle now. But imagine if this consistently happened every year – you’d soon be unable to afford the current lifestyle you have.

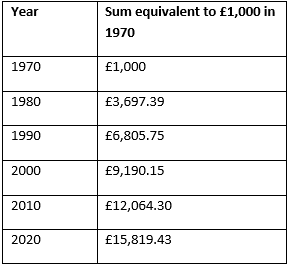

According to the Bank of England, inflation over the last 50 years has averaged at 5.7% annually. Starting with £1,000 in 1970, the below table demonstrates how your money would need to grow to maintain the same spending power over the years.

So, are you worse off in real terms this year? If your income increased by less than 0.8% in 2020, you experienced a pay cut in real terms.

It’s not just your salary that’s affected by inflation either – your savings and other assets can also decrease in value if they fail to keep pace.

How can you help your income and wealth keep pace with inflation?

Other than requesting a pay rise, there’s little you can do to ensure your salary increases in line with inflation. But you can take steps to grow other sources of income and wealth to maintain your spending power over the long term.

One current challenge is that interest rates are lower than inflation. This means the savings sitting in your bank are decreasing in real terms too. While it’s important to have an emergency fund, if your savings exceed six months’ worth of outgoings, it’s a good idea to explore alternatives to help you get the most out of your money. Investing is one option.

While investing does involve risk, markets have historically delivered stronger growth than inflation over the long term. As a result, investment provides an opportunity for your savings to not only match inflation but grow in real terms.

If you’d like to discuss how inflation is having an impact on your wealth, please give us a call. We can help you set out a long-term plan that focuses on preserving or building wealth so you can achieve your goals.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.