The amount the government collects through Inheritance Tax (IHT) is on the rise, and freezes to allowances mean it’s expected to increase further. If your family could face a bill... read more →

Imagine you could time travel to understand how your financial decisions today might affect your lifestyle in 10 or 20 years. You may be in a better position to turn... read more →

The BBC reports that heart-related deaths are at a 14-year high. One of the biggest risk factors is high cholesterol, a condition that over half of UK adults live with... read more →

Identity theft is a significant problem in the UK. Indeed, Infosecurity Magazine reports that 4.3% of the population – that’s 1.9 million Brits – had their identity stolen and used... read more →

When you think about what you want the future to look like, it’s probably not the value of your assets that comes to mind first. Instead, you might think about... read more →

Often one of the biggest benefits of a bespoke financial plan is that it allows you to devise a blueprint to follow, with your goals placed at the centre. It’s... read more →

As we approach the knockout stage of this year’s Euro 2024 Championship, I’ve been reflecting on my own memories from past tournaments over the years. From missed penalties to solo... read more →

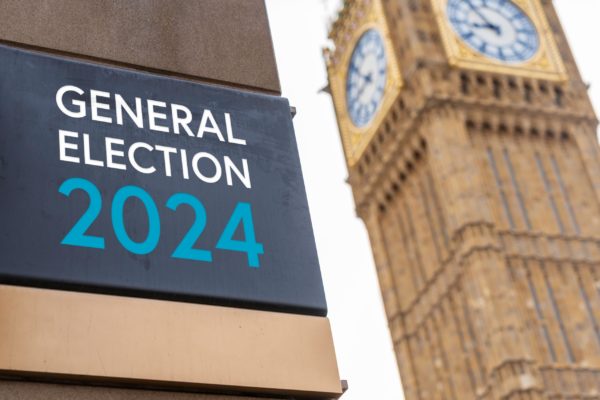

2024 has been called “the year of elections” with an estimated 2 billion people around the world heading to the polls. Voters in the UK will have their say on... read more →

How many times have you told yourself that you need to do more exercise, started a new routine, and then stopped it altogether after a few weeks as you just... read more →

With large amounts of money changing hands, property transactions can be enticing for fraudsters. Falling victim to a scam could mean you miss out on your new home and potentially... read more →